Jobless claims remain steady amid economic uncertainty

Jobless claims remain steady indicate a stable job market but vary by region, influenced by industry trends and government policies, impacting the overall economic outlook.

Jobless claims remain steady in a climate filled with economic uncertainty, leading many to wonder what this means for the job market. Are we seeing a stable labor force or is there more under the surface? Let’s dive into the details.

Analyzing the current jobless claims data

When we talk about analyzing the current jobless claims data, it’s essential to recognize the relevance of these statistics in understanding the overall economic landscape. Monitoring these claims provides insight into the health of the job market.

Key Statistics to Note

The most recent figures show that jobless claims have remained steady over the past few weeks. This steadiness can indicate a few underlying trends that are crucial to explore. For instance, a stable number of claims may suggest that people are holding onto their jobs despite economic fluctuations.

- Weekly jobless claims report details

- Highlighting trends in unemployment rates

- Understanding seasonal adjustments

- Comparison with previous months and years

Diving deeper into the trends, we see that certain industries are affected differently. For example, hospitality and leisure sectors often experience spikes in claims during off-peak seasons, while sectors like technology may remain stable year-round. By looking at these sectors, one can discern patterns and predict future claims.

Regional Insights

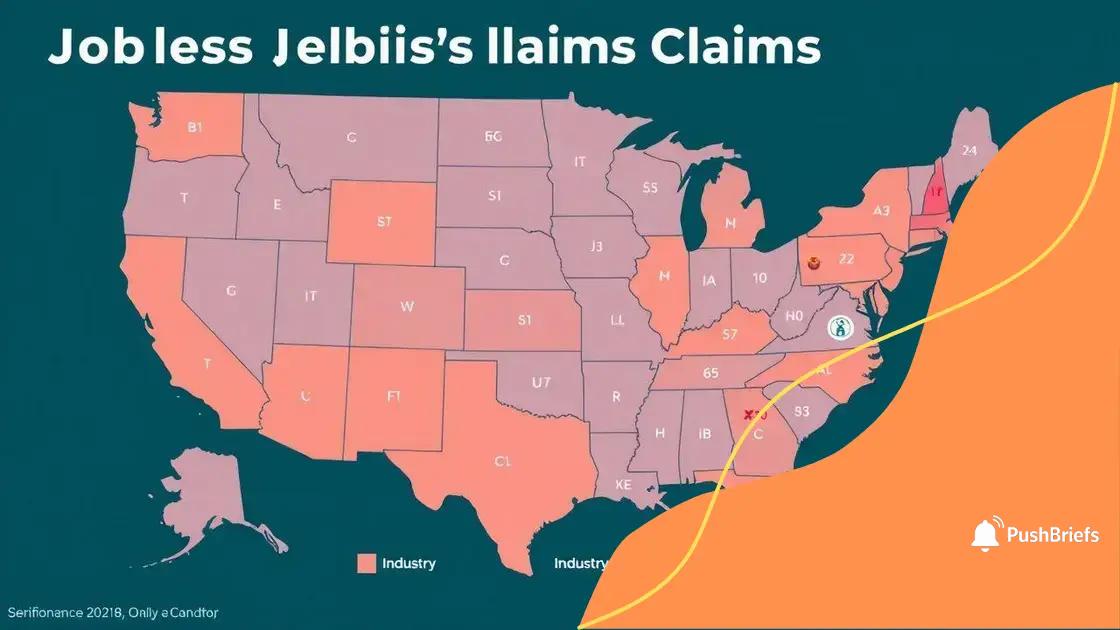

Another aspect to consider is the regional breakdown of jobless claims. Some states report higher claims than others, prompting questions about local economic conditions. For instance, areas heavily dependent on tourism may experience fluctuating jobless claims based on seasonal demand. The geographic disparity in claims can reveal much about local economies.

It’s also worth noting how governmental policies affect jobless claims. Initiatives like expanded unemployment benefits can lead to both increases and decreases in reported claims, depending on how effectively they are implemented. By understanding the social impact of policies, we can better analyze the data.

In conclusion, a comprehensive look at the current jobless claims data provides valuable insights into job market trends, regional variances, and the effect of economic policies. Staying informed about these claims helps gauge future economic stability and job opportunities.

Impact of steady jobless claims on economy

The impact of steady jobless claims on the economy is a topic that deserves close attention. When claims remain steady, it can have a variety of implications for economic growth, consumer confidence, and overall stability.

Economic Growth Dynamics

Steady jobless claims may indicate a resilient job market. When unemployment levels do not fluctuate significantly, businesses often feel encouraged to invest and expand. This can lead to increased economic growth as more jobs are created.

- Potential for rising consumer spending

- Increased job creation in various sectors

- Encouragement for business investments

- Stability in financial markets

Moreover, a steady job market can boost consumer confidence. People are more likely to spend money when they feel secure in their jobs. This increase in consumer spending can further stimulate the economy, creating a positive feedback loop.

Consumer Confidence Impact

As jobless claims stabilize, consumer confidence often follows suit. When individuals feel secure in their employment, they are more willing to make significant purchases, such as homes or cars. This behavior directly stimulates industries that rely on consumer spending.

Additionally, businesses may benefit from this increased demand. When consumers spend more, businesses can see hefty profits, leading to further hiring and investment. It’s a cycle that relies heavily on the state of jobless claims.

The relationship between steady jobless claims and economic stability is undeniable. By examining these claims, economists and policymakers can anticipate how other sectors will respond. Understanding this impact is vital for effective economic planning and response.

Regional variations in jobless claims

When discussing regional variations in jobless claims, it is essential to understand how different areas experience varying economic conditions. These differences can significantly impact local job markets and employment opportunities.

Understanding Regional Factors

Each region can be influenced by various factors, such as industry concentration, economic health, and demographics. For instance, regions with heavy reliance on tourism may see higher jobless claims during off-peak seasons, while areas focused on technology might maintain lower claims due to consistent hiring practices.

- Industry-specific employment trends

- Seasonal impacts on job availability

- Population shifts affecting labor supply

- Government policies and regulations

Looking at jobless claims by state also reveals disparities. Some states may have robust job markets, resulting in fewer claims, while others may struggle with high unemployment, leading to more significant claims. Understanding these patterns helps policymakers address local economic challenges.

Case Studies of Variations

For example, in states like California, the tech industry flourishes, leading to lower jobless claims. In contrast, areas reliant on manufacturing or agriculture may face challenges as industries shift globally. This can create job shortages, increasing local claims.

Beyond industries, factors like educational attainment and skills training play a role. Regions with higher education levels often report lower jobless claims, as residents are more adaptable to job market changes. Investments in workforce development can thus reduce jobless claims over time.

Analyzing these regional variations provides valuable insights into national trends. By recognizing how different areas respond to economic shifts, stakeholders can develop targeted strategies for growth and recovery.

Comparison with historical jobless claims trends

A comparison with historical jobless claims trends provides valuable insights into how current economic conditions stack up against the past. Tracking these trends allows analysts to spot patterns that can indicate future economic shifts.

Understanding Historical Trends

Historically, jobless claims tend to rise during economic recessions as businesses cut back on employees. Conversely, during periods of growth, claims typically decrease as more jobs become available. By examining these trends, we can better understand the effectiveness of economic policies over time.

- Identifying economic downturns

- Analyzing recovery periods and their duration

- Understanding policy impacts on employment

- Highlighting regional differences in jobless trends

Another important consideration is how technological advancements have affected job markets. For example, the rise of automation has changed employment landscapes, impacting historical jobless claims. Certain industries have seen a decline in claims due to increased efficiency, while others have faced significant layoffs.

Trends of the Last Decade

In the last decade, we have witnessed significant fluctuations in jobless claims, particularly during economic shocks. The 2008 financial crisis resulted in a massive spike in claims, which took years to stabilize. Comparatively, the recent pandemic-induced claims surged to unprecedented numbers, showcasing how quickly economic conditions can shift.

These historical comparisons also include looking at seasonal trends. Some sectors, like retail, experience predictable spikes in jobless claims during off-peak seasons, while others adapt without dramatic changes. A detailed understanding of these patterns helps anticipate future labor market behaviors.

By analyzing past jobless claims alongside current data, we can formulate more effective responses to economic challenges and better support those impacted by job loss.

Future outlook for jobless claims

The future outlook for jobless claims is a topic that hinges on various factors, including economic trends, government policies, and industry developments. As we look ahead, it is vital to consider how these elements will shape the job market.

Economic Predictions

Experts predict that jobless claims may continue to fluctuate as the economy adjusts post-pandemic. While some sectors are bouncing back, others continue to struggle due to supply chain issues or changing consumer behavior. This unpredictability makes it essential to monitor ongoing economic indicators closely.

- Potential effects of new government policies

- Impact of technological advancements on jobs

- Industry-specific recovery rates

- Global economic influences

Additionally, the rise of remote work has created new challenges and opportunities. Some businesses are shifting to more flexible work arrangements, which may reduce jobless claims in certain sectors but increase them in traditional ones. This trend indicates a significant transformation in how we view employment.

Government Interventions

Government actions also play a critical role in shaping the future of jobless claims. Continued support in the form of unemployment benefits and job training programs could help mitigate the number of claims. However, as federal assistance wanes, we may see a rise in claims if workers cannot find new employment.

The adaptation of policies related to unemployment insurance will further impact claims. If rules are modified to make it easier for workers to re-enter the workforce, jobless claims may decrease. Conversely, if assistance is withdrawn too quickly, claims could rise sharply.

As industries evolve, workers will need to acquire new skills to meet the demands of the job market. This shift highlights the importance of education and training initiatives in reducing future jobless claims. Preparing the workforce for upcoming changes can significantly influence overall employment rates.

FAQ – Frequently Asked Questions about Jobless Claims and the Economy

What do steady jobless claims indicate about the economy?

Steady jobless claims suggest a stable job market and can indicate economic resilience, as people are generally maintaining their employment.

How do regional differences affect jobless claims?

Regional differences can lead to varying jobless claims due to local industry reliance, economic health, and seasonal employment patterns.

What role does government policy play in jobless claims?

Government policies, such as unemployment benefits and workforce training programs, significantly influence jobless claims by helping individuals secure employment.

How can workers prepare for changes in jobless claims trends?

Workers can adapt by acquiring new skills through education and training, making them more competitive in the evolving job market.